North Carolina Soybean Producers Association

Promoting Soybeans. Supporting Farmers. Connecting Consumers.

-

2026 Soybean Schools

Join N.C. Soy and Cooperative Extension for a series of research-based soybean schools around the state. Registration information will be posted soon!

-

NC Commodity Conference

The NC Commodity Conference is moving to Greenville in 2026! Visit the official website to view registration information or to sign your organization up for sponsorship.

-

Yield Contest

Enter the 2025 NC Soybean Yield Contest and put your harvest to the test! Bragging rights, recognition, and prizes await the state’s top soybean growers. Enter by December 5th.

Soybean farmers and their checkoff, working through the North Carolina Soybean Producers Association and the United Soybean Board, are building innovative programs to increase the value of the soybean and its products.

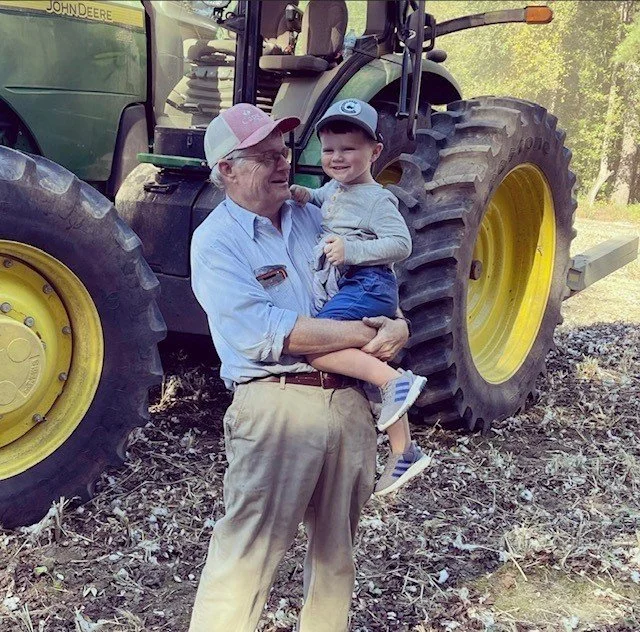

The Checkoff is devoted to supporting North Carolina Soybean farmers and making advancements that will impact the industry for generations to come, just like a family.

The Checkoff

Meet Your Farmers

Soybeans are the #1 crop produced in North Carolina.

95% of farms in North Carolina are owned & operated by families.