This week, Secretary of Agriculture, Sonny Perdue released the details regarding the Coronavirus Food Assistance Program (CFPA). This program is the $16 billion COVID-19 relief package for agriculture administered by the U.S. Department of Agriculture. The application period for assistance will begin May 26th through your local Farm Service Agency (FSA) office until August 28th. Here are some quick facts about CFAP for farmers in North Carolina.

APPLICATION

Local FSA offices are open for business, but by phone appointment only. Once the application period opens, please call your FSA county office to schedule an appointment. You can follow this link to find all of the forms to fill out prior to arriving at your FSA office and you can follow this link to USDA’s list of CFAP FAQs. You can fill out most of the forms before you arrive at the FSA office to help move to process along.

ELIGIBILITY

CFAP payments are available for eligible producers who have suffered a 5% or greater price decline from mid-January to mid-April 2020 because of the COVID-19 pandemic, and who are facing increased marketing costs for inventories.

PAYMENTS BASED ON

According to USDA:

“Producers will be paid based on inventory subject to price risk held as of January 15, 2020. A single payment will be made based on 50 percent of a producer’s 2019 total production or the 2019 inventory as of January 15, 2020, whichever is smaller, multiplied by 50 percent and then multiplied by the commodity’s applicable payment rates.

Producers must provide the following information for CFAP:

– Total 2019 production for the commodity that suffered a five percent-or-greater price decline

– Total 2019 production that was not sold as of January 15m 2020.“

WHERE WILL $ COME FROM?

Eligible farmers will receive one CFAP payment, drawn from two possible funding sources:

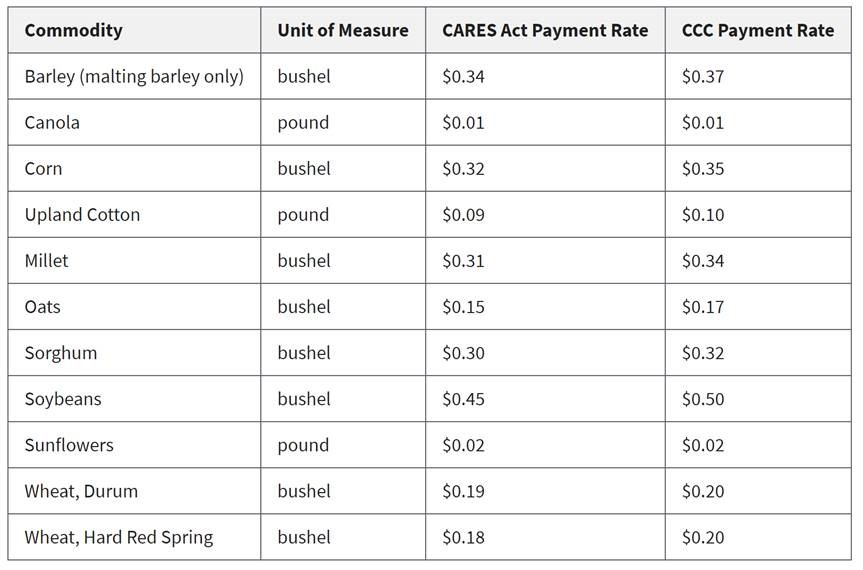

- The first source of funding is $9.5 billion in appropriated funding provided in the CARES Act and compensates farmers for losses due to price declines that occurred between mid-January 2020 and mid-April 2020 and for specialty crops for product that was shipped and spoiled or unpaid product. This payment rate for soybeans is $0.45/bushel.

- The second funding source uses the Commodity Credit Corporation Charter Act to compensate producers for $6.5 billion in losses due to on-going market disruptions. This payment rate for soybeans is $0.50/bushel.

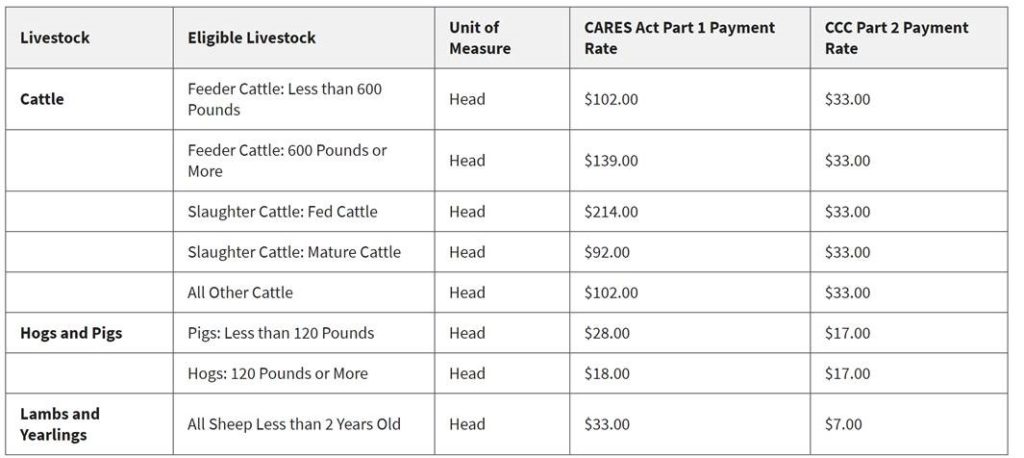

A complete list of eligible non-specialty commodities/livestock rates and the CFAP payment rates is below:

PAYMENT LIMITATIONS

The payment limitation for CFAP is $250,000 per person/entity for all commodities combined. To ensure there is available funding throughout the entire application period, farmers will receive 80% of their maximum total payment upon application approval, and the remaining portion will be paid at a future date as the funds remain available.

HOW DOES CFAP PAYMENTS COMPARE TO MFP

It is important to note tot the formula for payments will be based on 50% of 50% of 2019 production (essentially 25%). The 2018 MFP Payment rate for soybeans came in at $1.65/bu and the 2019 MFP rate at $2.05/bu. While the CARES Act and CCC combined payment rate is only at $0.95/bu. Below is the breakout of soybeans payments totaling up to $845 million compared to the 2019 MFP payment of approximately $7 billion for soybeans:

Total 2019 Soybean Production= 3,560,000,000/bu

Multiply the total by 50% of the 50%= 890,000,000

Multiply by the CARES Payment Rate ($0.45)= $400,500,000

Multiply by the CCC Payment Rate ($0.50)=$445,000,000

Add the two rates together= $845,500,000

SPECIALTY CROPS

Some specialty crops will be covered in this payment including: apples, avocados, blueberries, cantaloupe, grapefruit, kiwifruit, lemons, oranges, papaya, peaches, pears, raspberries, strawberries, tangerines, tomatoes, watermelons, artichokes, asparagus, broccoli, cabbage, carrots, cauliflower, celery, sweet corn, cucumbers, eggplant, garlic, iceberg lettuce, romaine lettuce, dry onions, green onions, peppers, potatoes, rhubarb, spinach, squash, sweet potatoes, taro, almonds, pecans, walnuts, beans, mushrooms. Please follow this link to see the payment structure and rates for specialty crops.

CROPS NOT COVERED

Commodities that did not suffer a five percent-or-greater price decline from mid-January 2020 to mid-April 2020 are not eligible for CFAP. Specifically, this includes sheep more than two years old, eggs/layers, soft red winter wheat, hard red winter wheat, white wheat, rice, flax, rye, peanuts, feed barley, Extra Long Staple (ELS) cotton, alfalfa, forage crops, hemp, and tobacco. However, for all commodities except for hemp and tobacco, USDA may reconsider the excluded commodities if credible evidence is provided that supports a five percent price decline.

More information including additional details on the livestock, dairy, and other CFAP components can be found here on farmers.gov.