Last week, Secretary of Agriculture Sonny Perdue, announced a second round of the Coronavirus Food Assistance Program (CFAP 2) that will provide an additional $14 billion to producers who have seen increased marketing costs associated with the COIVD-19 pandemic. CFAP 2 includes support for commodities that were left out of the first program, which is good news for a lot of N.C. farmers that had staple crops not covered in the first program. Payments will be broken down into three categories: price trigger commodities, flat-rate commodities, and sales commodities.

Here are some important things that we have learned over the past several days and that you need to know before applying.

APPLICATION

The application period for CFAP is currently open and will close on December 11, 2020. Growers will apply through their local USDA Farm Service Agency (FSA) office, but please note that some offices are open by appointment only.

USDA’s website also has useful tools including an option to signup online and payment calculators. CFAP 2 is a self-certification program, however, growers will need to reference their sales, inventory, and other records to fill out the application. Documentation is not needed to submit the application, but some growers may be asked to provide documentation after spot checks from FSA County Committees.

ELIGIBILITY & PAYMENT LIMITATIONS

Any grower/legal entity who shares in the risk of producing a commercial commodity may apply for CFAP 2, but the producers must be in the business of farming at the time of submitting their application. Contract growers who do not share in the price risk of production are not eligible for CFAP 2 payments. A grower/legal entity must also have an average adjusted gross income of less than $900,000 for 2016, 2017, and 2018 tax years.

The total CFAP 2 payment that a person or legal entity may receive, directly or indirectly through attribution of payments, is $250,000. Payments to legal entities such as to a corporation, limited liability corporation, limited partnership, trust, or estate, is $250,000 except if:

- two different members of the legal entity each provide at least 400 hours of active personal labor, active personal management, or combination thereof with respect to the production of 2020 commodities, then an entity may receive up to $500,000.

- three different members of the legal entity each provide at least 400 hours of active personal labor, active personal management, or combination thereof with respect to the production of 2020 commodities, then an entity may receive up to $750,000.

- Although the payment limitation is increased for the corporation, LLC, LP, trust, or estate, each members’ payment limitation (received directly or indirectly) remains subject to the $250,000 individual person payment limit.

PAYMENT CATEGORIES

Payments will be broken down into three categories: price trigger commodities, flat-rate commodities, and sales commodities.

PRICE TRIGGER COMMODITIES

Price trigger commodities are major commodities that meet a minimum 5% price decline over a specified period of time.

Row Crops:

- Eligible price trigger row crops include barley, corn, sorghum, soybeans, sunflowers, upland cotton, and all classes of wheat.

- Payments will be based on 2020 planted acres of the crop, excluding prevented planting and experimental acres.

- Payments for price trigger crops will be the greater of:

- 1) the eligible acres multiplied by a payment rate of $15 per acre;

- 2) the eligible acres multiplied by a nationwide crop marketing percentage, multiplied by a crop-specific payment rate, and then by the producer’s weighted 2020 Actual Production History (APH) approved yield. If the APH is not available, 85 percent of the 2019 Agriculture Risk Coverage-County Option (ARC-CO) benchmark yield for that crop will be used.

Soybeans fall into the price trigger category with payment calculated as:

eligible acres of the crop x nationwide marketing percentage (54%) x by crop-specific payment rate ($0.58) x producer’s weighted 2020 Actual Production History approved yield OR $15 per acre, whichever is greater

Broilers & Eggs

- For broilers and eggs, payments will be based on 75 percent of the producers’ 2019 production.

Dairy

- Dairy (cow’s milk) payments will be based on actual milk production from April 1 to Aug. 31, 2020. The milk production for Sept. 1, 2020, to Dec. 31, 2020, will be estimated by FSA.

Beef Cattle, Hogs & Pigs, Lambs & Sheep

- Eligible beef cattle, hogs and pigs, and lambs and sheep payments will be based on the maximum owned inventory of eligible livestock, excluding breeding stock, on a date selected by the producer, between Apr. 16, 2020, and Aug. 31, 2020.

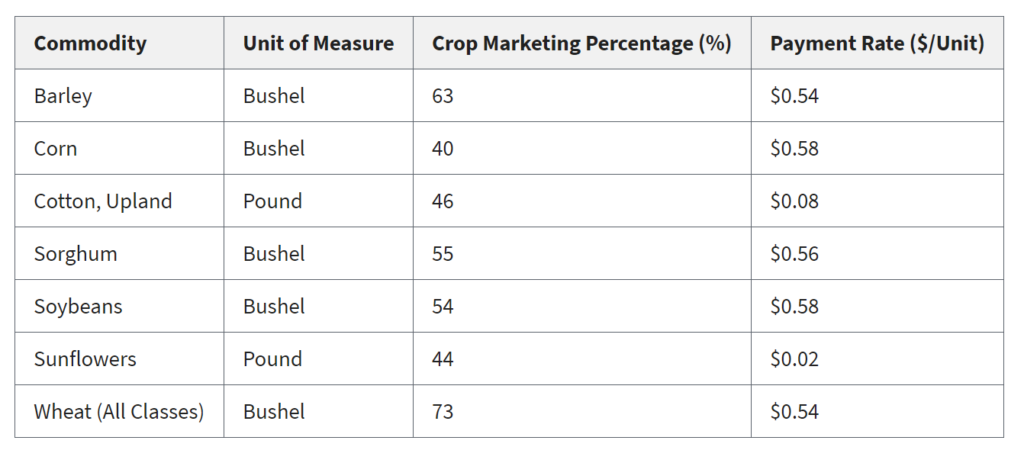

Marketing percentages and payment rates for each row crop that fall into the price trigger category can be found in the table below.

FLAT RATE CROPS

Crops that do not meet the 5% price decline trigger or do not have data available to calculate a price change will have payments calculated based on eligible 2020 acres x by $15 per acre. These crops include

- alfalfa, extra long staple (ELS) cotton, oats, peanuts, rice, hemp, millet, mustard, safflower, sesame, triticale, rapeseed, and several others.

SALES COMMODITIES

Sales commodities include:

- specialty crops; aquaculture; nursery crops and floriculture

- other commodities not included in the price trigger and flat-rate categories, including tobacco; goat milk; mink (including pelts); mohair; wool;

- and other livestock (excluding breeding stock) not included under the price trigger category that were grown for food, fiber, fur, or feathers.

- Payment calculations will use a sales-based approach, where producers are paid based on five payment gradations associated with their 2019 sales.

OTHER RESOURCES

You can also find USDA’s full press release from September 18th, on the release of CFAP 2.