It is no secret that the US agricultural sector has undergone a difficult past few years. Going into 2018 prices were low as part of the natural ebb and flow of a commodity cycle that is largely dictated by market fundamentals of petroleum as well as the strength of the US dollar. While most seasoned farmers were equipped to weather this storm, none could have predicted and few would be prepared for what was to come.

In April of 2018, China, in response to tariffs levied by the Trump administration, identified a list of 106 different American products, including numerous agricultural products, that would be subjected to a 25% tariff. The tariff went from the abstract to the concrete in mid-June when China announced a July 6th implementation date, and the impact on US agricultural products was immediate. With many US agricultural products effectively barred from the world’s largest market, prices began to fall with the steepest declines reserved for those commodities that relied most heavily on the Chinese market – with soybeans being chief among them.

Over the course of June, US soybean futures lost over 15% of their value and the USDA needed to act fast. Enter tariff aid and the Market Facilitation Program (MFP).

In this blog post we explore the design of tariff aid and the MFP in both its 2018 and 2019 incarnations as well as subsequently announced discretionary disaster relief. We go on to offer some analysis as to whether these programs are purely objective in their levels of support by commodity and geography or whether there were more political considerations at play.

What we find is that for 2018/19, payment calculations by commodity were both transparent and objective in the level of support offered across commodities but that with the advent of MFP 2.0, more political considerations crept in to play – seemingly with an eye on the needs of the flood-impacted Midwestern Farmer. Similarly, the design and timing of the Disaster Assistance Bill, signed in June, suggests that agricultural interests outside of the Farm Belt, can at times get pushed to the back burner.

Design of 2018/19 and 19/20 tariff aid packages

On July 24th, 2018, with prices for several key agricultural products in freefall, the USDA announced $12 billion dollars in trade mitigation programs (tariff aid) – ultimately launching those programs in early September. By far the largest of these mitigation programs was the Market Facilitation Program (MFP) payments with subsequent Congressional Research Service Analysis estimating the cost of this provision exceeding $9.5 billion. Nine commodities were eligible for MFP payments, five of which were row crops, two of which were livestock products and two more being tree crops. The size of the MFP payment made to growers was designed to reflect the degree to which it’s marketing was disrupted by tariffs – a detailed explanation of the calculation can be found here.

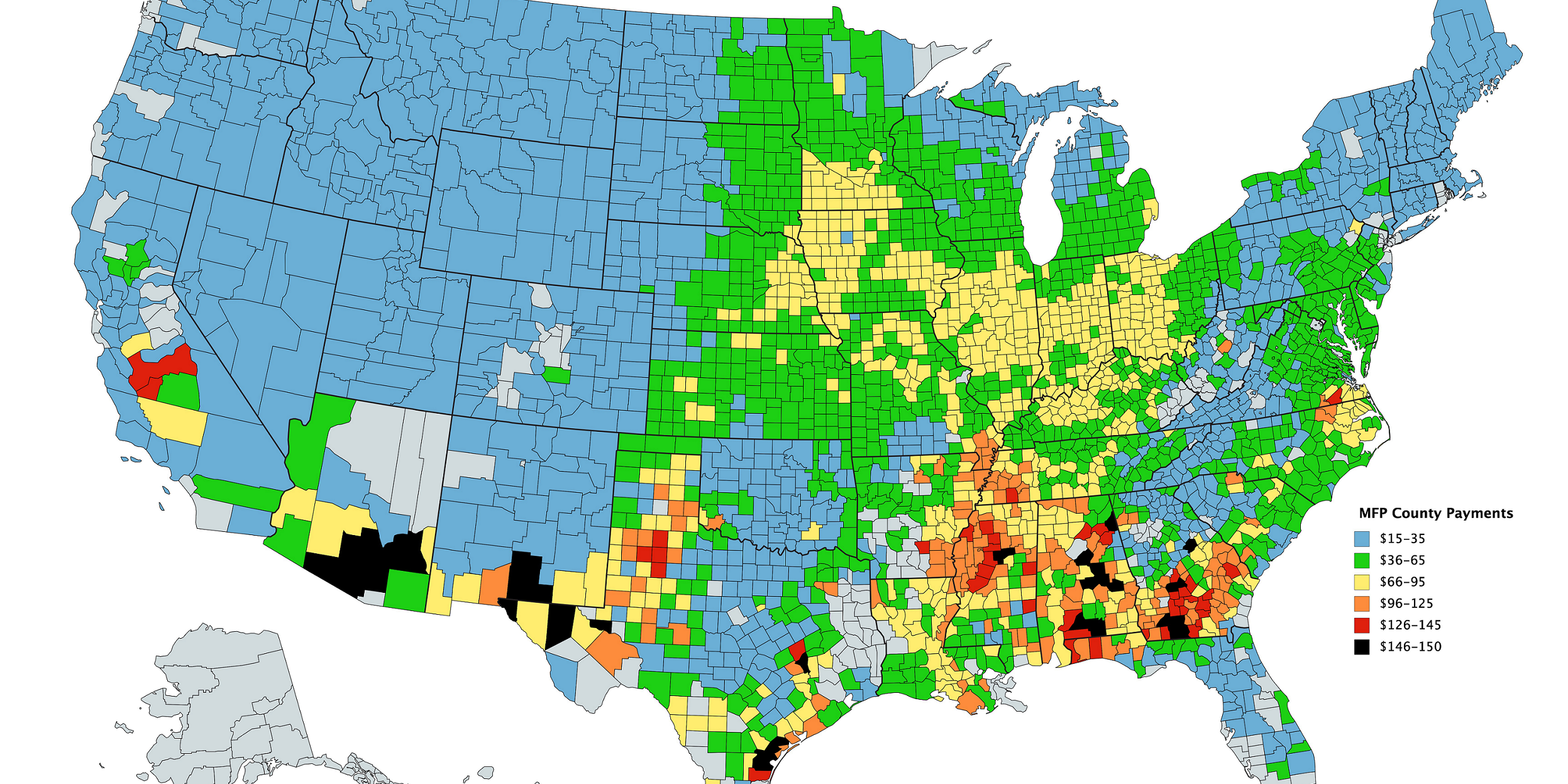

Diagram 1, below, illustrates a simplification of that formula and illustrates that, the larger the share of the commodity exported to countries that put tariffs in place, the larger the level of MFP support. While some commodity organizations ultimately voiced dissatisfaction with the size of the payment awarded, this diagram shows that the payments, as allocated across commodities, were both fair and objective. MFP payments were made on the basis of 2018 production, and for reasons we will get into when discussing payment mechanisms for the 2019 iteration of the MFP program, showed a lack of consideration for certain states, North Carolina being chief among them, making MFP payments less fair across geographies than they were across commodities.

Diagram 1: Relationship between 2018/19 MFP payments and share of product exported to China and Mexico

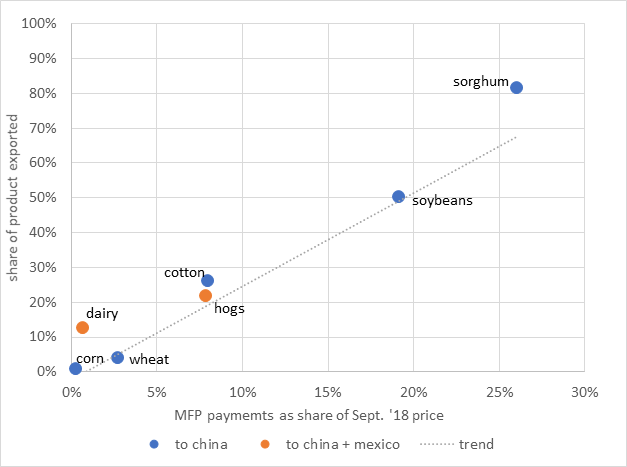

In addition to MFP payments, 2018/19 trade mitigation programs included a 1) Food Purchase and Distribution program and 2) an Agricultural Trade Promotion program. The Food Purchase program made purchases of $1.24 billion in 2018/19 with another $1.4 billion authorized under the 2019/20 package. Livestock products faired especially well under the Food Purchase provision, accounting for more than half of total purchases with the balance being made up with fruits, nuts and vegetables (Diagram 2). Row crops, like soybeans, received no support under this program.

The Agricultural Trade Promotion Program, meanwhile, was funded to the tune of $200 million dollars in 2018/19, with an additional $100 million granted under the 2019 package. While soybeans, as a discrete commodity group, was the largest recipient of these funds (Diagram 3), it was arguably underfunded relative to other row crops and livestock products if one were to use the same logic employed in MFP calculations, namely the degree to which the commodity was impacted by trade disruption, as a guide.

In the wake of USDA’s September 2018 implementation of tariff aid, US-Chinese trade negotiations went through a period of retaliation, renewed threats and false starts toward reconciliation. In early May of 2019, US tariff rates on $200 billion of Chinese goods increased from 10% to 25% with China hiking duties to 25% on $60 billion of US goods beginning June 1st. Throughout that time period, prices for the most impacted agricultural commodities, like soybeans, continued to fall and with no trade agreement in sight, the USDA announced $16 billion towards a second round of Trade Assistance on May 23rd.

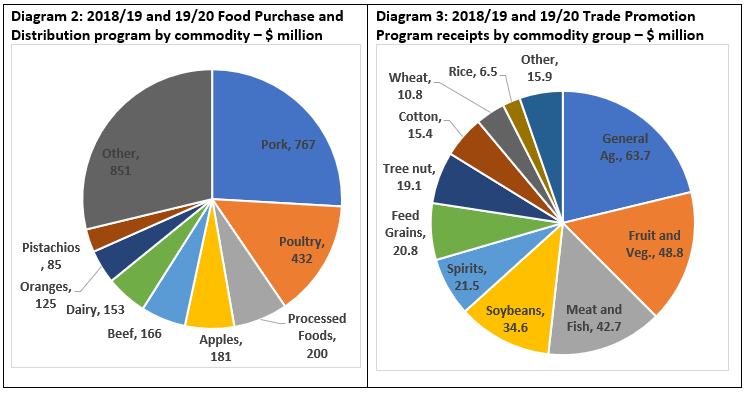

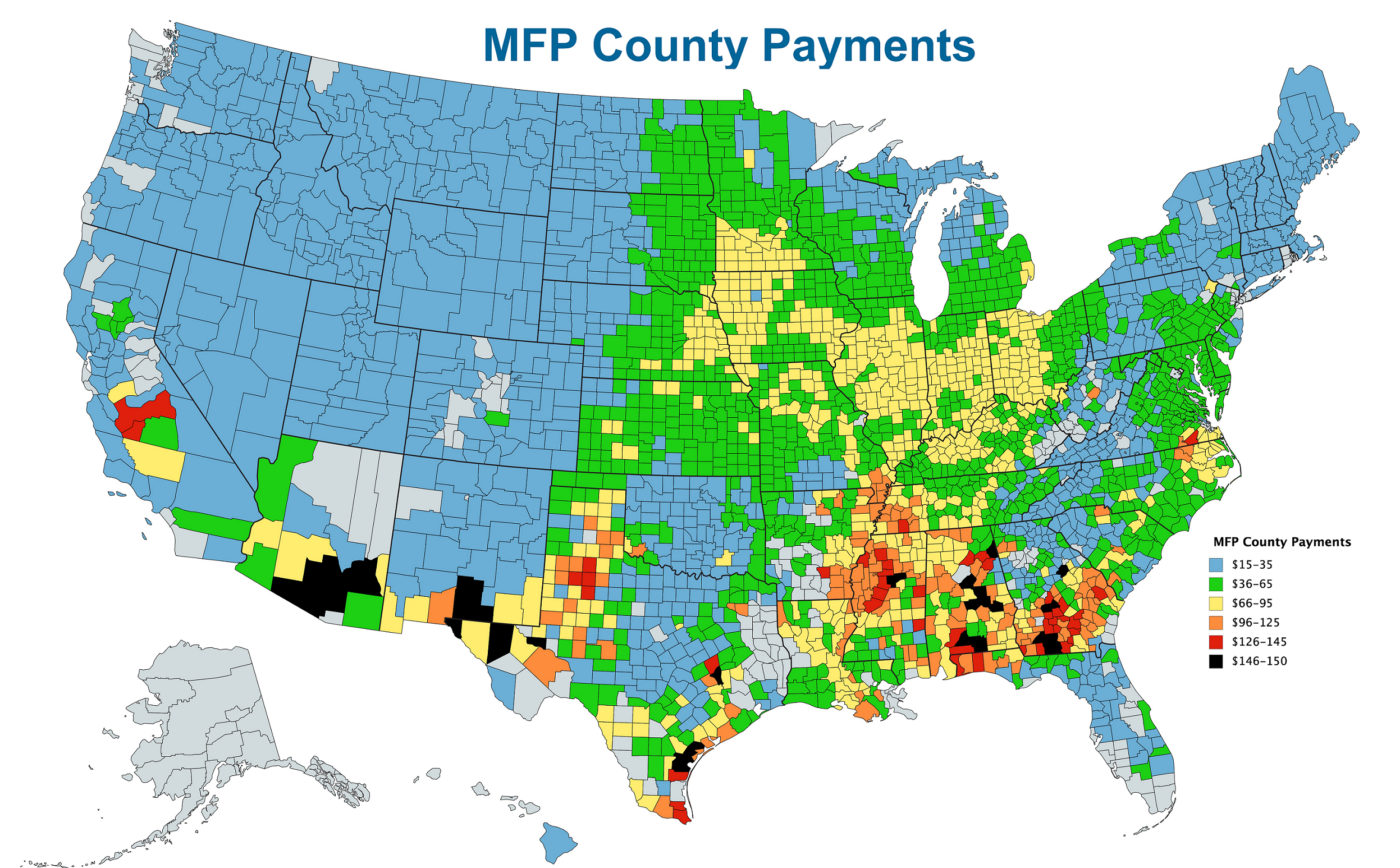

Under the 2019/20 iteration of tariff assistance, mechanisms for food purchases and trade promotion were the same as 2018/19, even if the funding levels were slightly different as discussed above. However, the design of the component funneling aid directly to farmers, namely the MFP payment, was quite different. For 2019/20, in an effort not to skew planting decisions, the $14.5 billion in MFP funding would be based on a county-level rate rather than payments being tied to a specific commodity. This county-level rate would be applied across the acreage planted under all MFP eligible commodities to determine total trade assistance paid to an individual farmer. Critically, 2019/20 MFP assistance was tied to acreage planted, rather than production – a clear win for Midwestern farmers who will see a major reduction in yields stemming from historic flooding. In 2018/19, by contrast, with MFP payments tied to yields, North Carolina farmers reeling from the impacts of Hurricane Florence & Michael received no such consideration.

The USDA released the county-level MFP payment rates on July 25th (Diagram 4). While subsequent investigations by the agricultural community would find that payment rates were based on a function of 1) the 3-year average RMA yields for the county, 2) the 4-year average FSA planted acres for the county and 3) the damage rates for the covered crops, the Department has been fairly cagey in terms of releasing further details. For 2018/19 the Department released explicit damage rates and compensation values by commodity – something they have, so far, refused to do for 2019/20.

Diagram 4: MFP payment rates by county

Estimating the implied value of select commodities according to 2019/20 MFP payments

While the USDA did not provide explicit compensation values by commodity, the shear number of county-level payments provided, coupled with ample yield and acreage data for these counties, means that in the case of some commodities, implied compensation rates can be estimated statistically. Given the dominant position of soy and corn in terms of acreages planted across the country, estimates of implied compensation values for these commodities are likely to be the most robust.

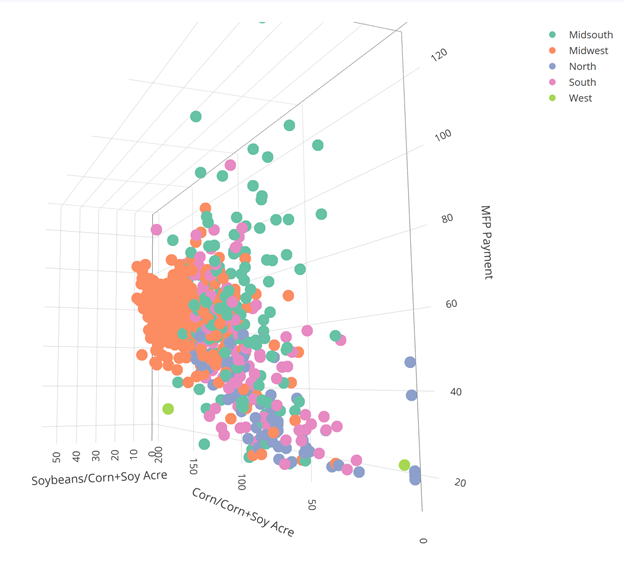

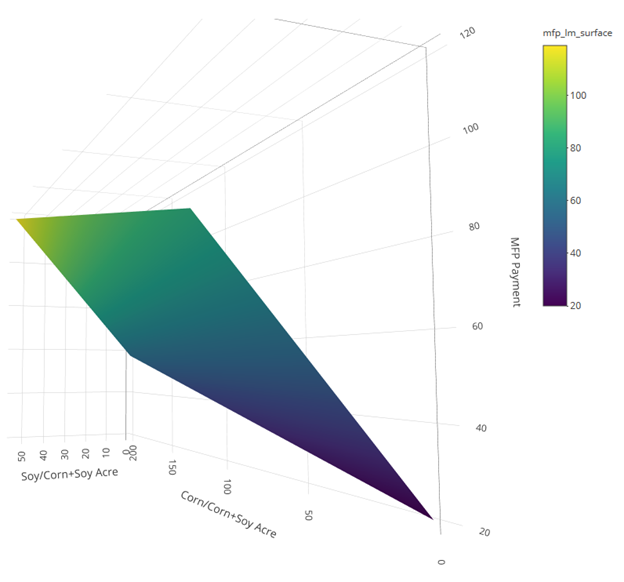

To estimate these values, we began by selecting all US counties where more than 95% of acres planted to MFP eligible crops were in corn and soybeans. Next, we found three-year average production and acreage values for corn and soy. A simple calculation was performed to determine 1) corn production over corn + soy acres and 2) soy production over corn + soy acres. These values served as our independent variables and allow us to account for relative acres in corn and soy, and yields. The MFP payment rate, meanwhile, is used as our dependent variable. The scatterplot resulting from these three series is illustrated in Diagram 5 while the plane resulting from the ensuing regression is illustrated in Diagram 6.

Diagram 5: MFP rates compared to the relative share of corn and soy production per county

Diagram 6: Implied MFP rates for corn and soybeans based on relative share of corn and soy production per county

After obtaining coefficients for our two independent variables, we estimated the implied MFP value of an acre of corn or soybeans by doing the following:

- To determine the MFP value of an acre of corn, we set the soy/(corn+soy acres) coefficient equal to zero and set the corn/(corn+soy acres) coefficient to 176 – the three year average US corn yield.

- To determine the MFP value of an acre of soy, we set the corn/(corn+soy acres) coefficient equal to zero and set the soy/(corn+soy acres) coefficient to 51 – the three year average US soybean yield.

In doing so, we find that the value implied by 2019/20 MFP county rates is $0.30 per bushel of corn and $1.52 per bushel of soybeans.

Table 1: Implied value of corn and soybeans under 2019/20 MFP payments

| Implied MFP value based on 16-18 avg. yield ($/ac) | Avg. MFP value ($/bu) | Marginal MFP value above $15/acre minimum ($/bu) | Makret valuation of commod. based on 16-18 avg. yield & price ($/ac) | MFP as a share of market valuation | |

| Corn | 52.8 | 0.30 | 0.22 | 604.4 | 8.7% |

| Soy | 77.3 | 1.52 | 1.22 | 474.2 | 16.3% |

Is the valuation of commodities implied by 2019/20 MFP rates purely a reflection of the damage they have incurred in the trade dispute or are political considerations at play?

As mentioned earlier in this post, 2018/19 payment rates by commodity were both transparent and purely objective in the sense that they were tied to the level of damage sustained by tariffs on US agricultural products. Under the 2018/19 iteration, MFP payment rates were $1.65/bu for soybeans and $0.01/bu for corn. A look at the implied valuation rates in Table 1 ($1.52/bu for soybeans, and $0.30/bu per corn) may lead one to assume that market conditions for soy have gotten better while growing worse for corn – something that is not supported by the data.

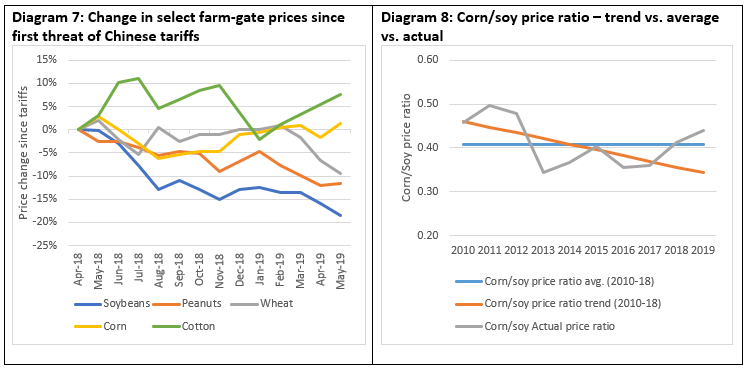

Diagram 7, for instance, reveals the extent to which prices for select commodities have evolved since the Chinese first threatened tariff retaliation in April of 2018. Since then, soybean prices have registered the biggest declines, by far, down nearly 20% through May 2019. Corn prices, meanwhile, have been quite stable, falling slightly in the summer of 2018 but recovering since then. A look at the relative pricing of soybeans and corn over time does little to overturn the idea that soybeans have been harmed far more than corn from the trade war. The ratio of corn/soybean prices was above the 2010-18 average last year and well above the 2010-18 trend with more of the same projected for 2019/20 (Diagram 8).

With market dynamics unable to account for the seeming reversal of fortunes in MFP valuations for corn and soy over the past year the appears to be political considerations at play. By increasing the MFP valuation for corn relative to soy, the USDA will be able to spread MFP payments more evenly across large swaths of Midwest – providing support to a broader share of a constituency that has been hammered by low prices over the past few years.

Consulting the county-level payment map (Diagram 4) speaks to this broader distribution but also illustrates the degree to which the cotton and peanut belt in the southern tier benefitted from high rates. Revisiting Diagram 7, however, we observe that cotton prices, are actually up in the period that the trade war has been underway, suggesting that its current bout of low prices may be more rooted in preexisting market fundamentals than tariffs. Peanut prices, meanwhile, have fallen by over 10% during the observed time frame, but only a small portion of their export market has been impacted by tariffs. It is estimated, for example, that between the EU tariff on peanut butter and the Chinese ban on all peanut products, fewer than 100,000 tonnes of US exports on an annual basis, or less than 3% of US peanut production, were directly impacted by tariffs. Again, this suggests that market fundamentals (skewed by domestic policy), rather than the trade war may behind much of the decline in peanut prices.

Given the large payments conferred to peanut and cotton counties, coupled with evidence suggesting the trade war’s impacts on these commodities was muted, these commodities appear to be the vessel by which MFP payments were spread throughout the South, just as corn helped make payments more even across the Midwest.

Timing and design of disaster relief payments

In the midst of the trade disputes that have arisen over the past 18 months American farmers have also had to contend with some abysmal weather. While weather problems began in the fall of 2018 with flooding brought on by Hurricane Florence in the Carolinas it is the historic flooding that hit the Midwest in the spring of 2019 that has received more attention.

On June 6th President Trump signed a $19.1 billion disaster aid bill – not a moment too soon for Midwestern farmers but a full nine months after Hurricane Florence inundated the Carolinas. Included in the bill was $3.005 billion dollars worth of aid to farmers to help cover crop losses from disasters spanning the 2018 and 2019 crop years. Beyond specifying the $3 billion total, the bill offered few details on how the money would be allocated across the country, or how it would mesh with the $15 cover crop provision of MFP 2.0 – arguably a form of weather-related assistance in its own right.

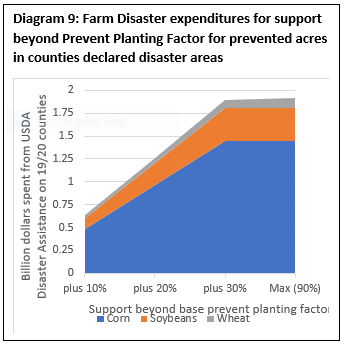

The language of the bill did specify that money could be used to increase coverage of losses caused by prevented plantings in 2019 to up to 90% of the insurance guarantee or up to 70% for uninsured crops. Coverage up to the existing Prevent Planting Factors, which generally range from 50%-60%, would come from RMA funds as normal, but any bridge to the 90% level or coverage on uninsured crops would come from the $3 billion of disaster aid available to farmers.

Diagram 9 illustrates the cost to the USDA for increasing prevented plant coverage by 10%, 20% and 30% over the Prevent Planting Factor as well as up the maximum of 90%. The diagram assumes 1) an 85% insurance coverage level across the board and 2) that 100% of acres are insured (closer to 90% in reality) and shows that costs could approach $2 billion dollars for 19/20 prevent plant Corn, Soybeans and Wheat if this option was fully exercised – leaving little left over for the effects of Florence felt in North Carolina.

Summary and Conclusions

Farmers’ first preference will always be to first, farm and then, to sell their crops on the open market. In the last 18 months, however, we have seen these natural inclinations of growers run up against some major roadblocks. The details of the first round of tariff assistance, announced in August of 2018, included MFP calculations that were both transparent and objective in the level of support they provided commodities impacted by the trade war. Certain quirks of design in MFP 2.0, however, suggested that the 2019 iteration had more political considerations at play.

While not delineated explicitly, through statistical analysis or simply by viewing a map of county rates, it appears that a number of commodities were valued more highly in the MFP 2.0 calculations than would have been warranted by looking at tariffs’ impact on prices. Corn, for example, appears to have been used as a mechanism by which to spread payments more evenly across the Midwest, while more payments were channeled to the South using peanuts and cotton. Given the degree to which soybean prices have been adversely impacted by Chinese tariffs, it, by contrast, was not a big winner under the 19/20 MFP program. The fact that 19/20 MFP payments were tied to planted acres, was a departure from the 18/19 production-based approach that was clearly designed with the flooded-out Midwestern farmer in mind. The North Carolina farmers impacted by Hurricane Florence in 2018/19, meanwhile received no such consideration.

Lesser discussed tools under both the 2018/19 and 2019/20 tariff aid packages included the Trade Promotion Program, where soy did well in receiving $35 million of the $300 million spent over two years. This was a pittance, however, compared to the $2.6 billion spent under the Food Purchase and Distribution Program, which directed aid to more consumer-facing products, few of which were impacted by tariffs to the same extent as soybeans.

Turning from the commodity specific support of the tariff assistance programs to whole farm support offered under USDA’s $3 billion in Disaster Assistance funding we are given reasons to believe that the latter was also not designed with the Southern farmer at top of mind. First, from a timing perspective, the Disaster Assistance bill was signed in early June, right on the heels of Midwestern Flooding, but a full nine months after flooding caused by Hurricane Florence. Additionally, from a program design perspective, the Disaster Assistance bill opens up the possibility that up to two-thirds of the money available could go to further compensate Midwestern farmers, leaving less for the 18/19 hurricane impacts felt in the Carolinas.

While the North Carolina grower is greatly appreciative of the assistance offered by USDA over the past 18 months – which has been critical to farm survival in some instances – we look forward to working more closely with the USDA in the future to make sure ad hoc agricultural policies are designed for farmers inside and outside the farm belt, alike.